The Power of Integrated Marketing in the BFSI Sector: Connecting, Engaging, and Thriving in the Digital Age

In today’s ultra-competitive banking, financial services, and insurance (BFSI) landscape, standing out is no easy feat. Brands face the challenge of engaging customers across a fragmented, digital-first environment where traditional marketing strategies no longer suffice. What worked for decades—billboards, TV ads, and cold-calling campaigns—is no longer enough to capture the imagination of today’s consumers. With consumers now demanding more personalized, and trustworthy experiences, BFSI businesses must evolve their marketing approaches to remain relevant.

Whether you are a giant like State Bank of India or a fintech disruptor like Paytm, one thing is clear: traditional marketing strategies just don’t cut it anymore. Today’s consumers are more tech-savvy, informed, and demanding than ever before. They are online – whether it’s through Google searches, social media platforms, or comparing investment options across fintech apps.

To capture their attention, BFSI brands need hyper-targeted strategies that engage the right audience at the right time.

At PromotEdge we understand the unique demands of your clients. We rely on the data to analyze the current and future trends and offer you reliable solutions that make you gain in the list of leading BFSI brands.

Show more

Branding Agency for BFSI

In a World Built on Trust, Branding is the Foundation of Success for Banking, Financial Services, and Insurance Businesses

We live in a highly competitive financial landscape, where trust is the currency and every moment is an opportunity to win—or lose—a customer. Branding in the banking, financial services, and insurance (BFSI) sector is far more than a visual exercise. It’s about creating compelling narratives that resonate with your customers, employees and stakeholders and create a sense of reliability, innovation, and belonging. For instance, LIC’s tagline “Zindagi Ke Sath Bhi, Zindagi Ke Baad Bhi” has a deeper meaning. It assures individuals that even if they’re not there, with the policy their family will be able to look after themselves.

In a digital-first world, BFSI businesses need to understand that the competition isn’t just on interest rates, premiums, or services— it’s on trust, convenience, and emotional connection. Whether it’s a young fintech startup vying to disrupt traditional banking giants or an insurance company with a rich history, it’s not an easy battle. To establish a reputation, and a track record of success and reliability, like the LIC, trying to appeal to a new generation, BFSI brands need something more than financial products and their features. It’s about creating a brand identity that stands out, builds trust, and fosters long-term relationships.

Creative Designing Agency for BFSI

The Power of Creative Design in Shaping BFSI Brands for the Indian Market

In a world where every swipe, click, and scroll competes for attention, creative design is more than just about brand appearance. It’s about driving engagement, building trust, and creating a lasting impact on your banking, financial services, and insurance (BFSI) brand. Whether you are a fintech startup trying to stand out, or a legacy public sector bank looking to stay relevant, design plays a crucial role in converting fleeting interest into loyal customers.

You need to take into consideration every design element—from your banking app’s colour scheme to the user-friendly experience on your insurance claims portal. Every decision should reinforce one key message: stability, reliability, and innovation. Take HDFC Bank’s Infinia credit card, for example. Its sleek design not only screams exclusivity but directly targets high-net-worth individuals. On the other hand, ICICI Bank’s logo is a mix of 4 colours, orange blue, maroon and blue with each representing something meaningful.

Digital Marketing Agency for BFSI

Banking on Digital: Explore the Future of Marketing for BFSI Brands

In the bustling corridors of India’s financial ecosystem, one thing is clear! Consumers no longer walk into a bank branch or an insurance office as their first step toward financial decisions. Instead, they reach for their smartphones, type a query into Google, or visit the YouTube channel of a popular finance influencer hoping to find answers, inspiration, or assurance. Your digital footprint isn’t just a support act anymore—it’s the main stage.

For banking, financial services, and insurance (BFSI) businesses, this digital shift is both an opportunity and a challenge. In a world where a smooth app experience can trump decades of brand legacy, the question isn’t whether to invest in digital marketing, but how to do it right. PromotEdge has the answer to your how’s, why and when questions. Whether it’s SEO, social media management, email marketing or personalized communications on WhatsApp, we’re ready to assist you.

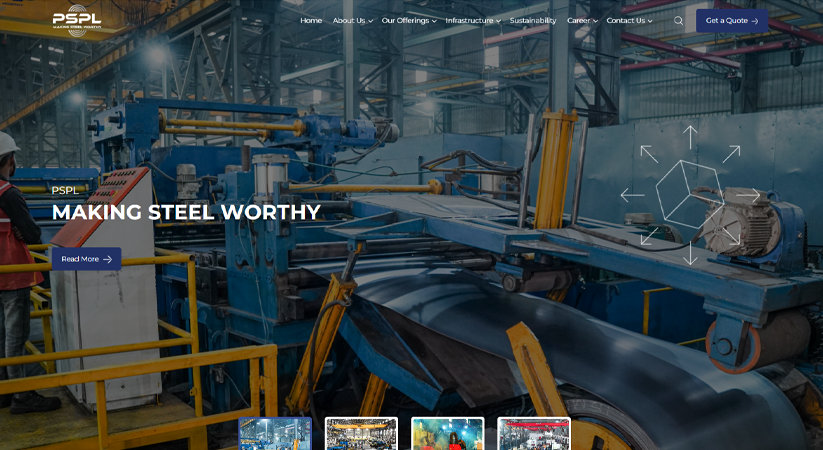

Website Agency for BFSI

Engage, Convert, Retain: Transforming BFSI Websites for Higher Convenience

Imagine a young entrepreneur in Bengaluru scrolling through a laptop late at night, looking for the perfect venture capitalist to fund her startup. The individual clicks on a promising link, only to land on a clunky website that takes forever to load. Frustrated, they move on to the next option. Though it may seem a small thing, in that moment you may lose the trust of a potential customer.

In today’s hyper-connected world, your website is not just a digital presence—it’s your handshake, your pitch, and your storefront. And for BFSI businesses, where trust and clarity can’t be negotiated by any means, a poorly designed website can mean the difference between winning a loyal customer and losing them to a savvier competitor.

For banking, financial services, and insurance (BFSI) businesses operating in or expanding into India, the importance of offering an exceptional website experience cannot be overstated. In today’s digital-first world. Your website is likely to be the first touchpoint with your customers, an introduction to your brand’s vision and value proposition. It must be intuitive, visually appealing, and functionally robust to capture the attention of a digitally savvy audience.

Audio-Visual Agency for BFSI

Building Relationships, Trust, and Emotional Connections with the Power of Visual Storytelling in BFSI Marketing

Imagine this: A young entrepreneur scrolls through her phone, exploring financial products to fund her next big idea. Between a sea of complex jargon and generic promises, a crisp, visually stunning video catches their eye. It’s a real-life story of a small business owner who scaled their dreams with a unique loan product. The visuals are vibrant, the narrative relatable, and the trust it evokes—instant. That’s the power of audio-visual storytelling in action.

In a marketplace teeming with choices, the BFSI sector in India faces a unique challenge: building trust and standing out in a sea of competitors. Financial products and services can be complex for the general audience as they are no experts. Audiovisuals help brands engage better, share complicated information with your existing and potential clients and keep them updated. When you think about visual storytelling, many often forget it’s not about creating eye-catching ads. What you need to focus more on is crafting narratives that resonate deeply with customers.

In the BFSI sector, consumers are not just putting their money, investments, and financial security, they are also putting their trust. Adding a well-crafted video on your website or social media platform can serve as the perfect hook, drawing audiences into your story and gaining their interest in your services.

Where Every Logo Tells A Success Story

Our 200+ Collaborations.

Client Happiness Speaks Volumes

Key Considerations While Marketing BFSI Businesses

One

Building Emotional Connections

Financial services aren’t always just about products; they’re also about someone’s life and dreams. Brands need to connect emotionally with customers to win over their trust. Creative design and campaigns that highlight aspirations, security, and empowerment leave a strong impression. It also builds meaningful and lasting relationships.

Two

Consistency For Brand Recall

Customers interact with BFSI brands through multiple channels, including apps, websites, physical branches, and social media. A disjointed brand experience can confuse and erode trust. BFSI brands need to focus on maintaining a unified brand identity by aligning design elements, tone, and messaging across all platforms.

Three

Establishing Trust Through Visual Design

Customers entrust BFSI brands with their finances, savings, and future security. Marketing strategies, therefore, must reflect this responsibility. Trust being foundational in BFSI, every design choice – whether a colour palette, logo, or user interface – must communicate reliability, stability, and care.

Four

Improving Customer Experience

As BFSI brands are leaning towards online, customers expect more than just functionality. They want platforms that are safe and easy to use. Offering multiple language options, accessible design features, and interactive elements that guide users through complex processes improves customer experience and builds loyalty.

Case Study

Blogs

Read Tomorrow’s Insights Today

Got Questions?

-

How can BFSI brands connect with their target audience spread all over India?

Ans.As BFSI brands target PAN India, it’s important for them to focus on localized digital storytelling. India is a diverse country so they need a narrative that resonates with cultural nuances and customer aspirations to connect the vast consumer base. By adding emotional and relatable sentiment to their narrative, brands can build a strong bond with their customers. As a “digitally desi” company PromotEdge specializes in tailoring campaigns to local preferences. Schedule an appointment with us today! -

How can BFSI brands maintain consistency across multiple customer touchpoints?

Ans.Consistency in branding means you need to offer the same experience across all platforms. Be it a mobile app, website, social media, or physical branch, it's essential to offer a satisfying customer experience. Integrating tools like chatbots, dashboards, and customer communications that reflect the same tone and values can work in your favour to maintain trust and reinforce the brand identity. -

What makes a BFSI brand authentic and relatable to customers?

Ans.A BFSI brand becomes authentic and credible when its branding efforts align with its core values and customer expectations. Whether through ESG initiatives, community outreach, or transparent practices, brands like LIC, SBI, PNB and ICICI have been able to build trust by sharing relatable stories of impact. -

Why is emotional storytelling important for BFSI brands?

Ans.Modern consumers value brands that clearly represent their aspirations and values. Emotional storytelling allows BFSI brands to connect authentically with their audience, transforming complex financial products into relatable narratives. This fosters trust and positions the brand as a partner in the customer’s financial journey rather than just a service provider. -

Why are traditional marketing strategies no longer very effective for BFSI brands?

Ans.Traditional approaches like billboards, TV ads, and cold-calling don’t engage today’s tech-savvy and informed consumers effectively. Modern audiences, especially Gen Z and millennials spend a pretty good amount of time scrolling through their smartphone. Plus with a lot of options, they look for a seamless, personalized, and trustworthy experience. BFSI brands must shift to integrated, data-driven strategies that connect emotionally and authentically with their target audiences across digital touchpoints. -

How can BFSI brands educate customers about their products and services?

Ans.In the digital-driven world, brands can use different ways to share insights including blogs, webinars, and tutorials. It simplifies complex topics like mutual funds, insurance policies, or tax-saving strategies. Discuss with us to know more about how we can help you. -

How can BFSI brands leverage digital tools to engage their audience?

Ans.BFSI brands can use social media platforms like Instagram, Facebook, and YouTube to foster connections through storytelling and influencer collaborations. Tools such as gamified savings apps, augmented reality (AR), and personalized recommendations powered by AI create engaging and memorable customer experiences. These strategies enhance brand visibility and build loyalty. -

What role does data play in modern BFSI marketing strategies?

Ans.When it comes to marketing, the more you know your customers the better engagement rate you can expect. Advanced analytics and AI tools help brands understand customer behaviours, predict what they are looking for and personalise communication accordingly. For instance, HDFC Bank offers customized “PIXEL” credit card offers which have attracted the attention of many consumers. -

How can BFSI brands leverage data for more effective marketing?

Ans.Digital platforms like websites and social media are a great source of valuable information. By analyzing user behaviour, BFSI brands can refine their marketing strategies. For instance, they can run targeted ads and more personalized campaigns to improve customer engagement. -

How can a website help BFSI brands better customer relationships?

Ans.Frankly, with 9-5 jobs, and a busy lifestyle, it can be difficult for many individuals to visit their branch when an issue arises. However, with BFSI websites that have feature tools like chatbots, and EMI calculators, a customer or a potential customer can easily gain all the crucial information they need, which makes them feel more comfortable and close to the financial institution. -

Why is cybersecurity a priority for BFSI platforms?

Ans.BFSI platforms handle sensitive financial data, so there is no thought of compromising on cybersecurity. We help brands to take the essential measures to protect customer information and maintain trust.